Analog IC Market Insights In Q1 2023

As an important type of semiconductor product segments, analog stood out in 2022. The Semiconductor Industry Association (SIA) announced global semiconductor industry sales totaled $573.5 billion in 2022, the highest-ever annual total and an increase of 3.2% compared to the 2021 total. Among various types of semiconductor products,analog had the highest annual growth rate of 7.5%, reaching $89 billion in 2022 sales.

The global semiconductor market has experienced significant ups and downs in 2022, with record-high sales early in the year followed by a cyclical downturn later. The demand signal of the chip market continues to be readjusted around the world and global semiconductor sales have fallen as a whole, and the lead time of most products has been greatly shortened.

According to data from Susquehanna, in December 2022, Lead times- the gap between when a chip is ordered and when it is delivered- averaged about 24 weeks, which is 8 days shorter than the previous month, the largest monthly decline since 2017. The lead times of analog IC has also been shortened, but it is still at a relatively high level.

In this context, what everyone is concerned about is whether the sales momentum of analog IC in 2022 will continue in 2023?

“Despite short-term fluctuations in sales due to market cyclicality and macroeconomic conditions, the long-term outlook for the semiconductor market remains incredibly strong, due to the ever-increasing role of chips in making the world smarter, more efficient, and better connected.” said John Neuffer, SIA president and CEO.

The analog IC plays an significant role in semiconductor industry. It mainly undertakes the tasks of transmission and energy supply in the circuit. It is used to generate, amplify and process analog IC signals in the form of continuous functions such as sound, temperature, etc. These chips are commonly used in vehicles, communications, Industrial control system, consumer electronics.

From historical data, the overall growth rate of the global analog IC sales is lower than that of integrated circuits, but the market volatility of the analog industry is relatively small, and because analog IC does not rely on advanced manufacturing processes, the product life cycle is long and the price fluctuate a little. In the context of the downturn in the semiconductor market, the impact is relatively small.

From the perspective of the downstream market, electrification and intelligence are the future trends of automobiles, and the incremental demand for analog is driven by this. Analog IC can be applied to almost all automotive electronic components. In addition to traditional automotive electronics such as in-vehicle entertainment, instrument panels, body electronics and LED power management, they are also widely used in power systems of new energy vehicles, smart cockpit systems of smart cars and autopilot systems, etc.

In addition, the development of 5G communication and the upgrading of mobile phone functions drive the growth of the analog market, and a variety of analog IC from the signal chain to the power chain are expected to benefit from this. The rapid growth in the number of industrial-grade IoT terminals has also pushed up the demand for analog IC.

According to WSTS, it is expected that the analog IC market will continue to grow in 2023, and analog IC market sales are expected to increase by 1.56% to reach 90.952 billion dollars.

There are many types of analog IC, and the segmented products have a large market span, with significant technical differences between them, and market supply and demand are not quite consistent.

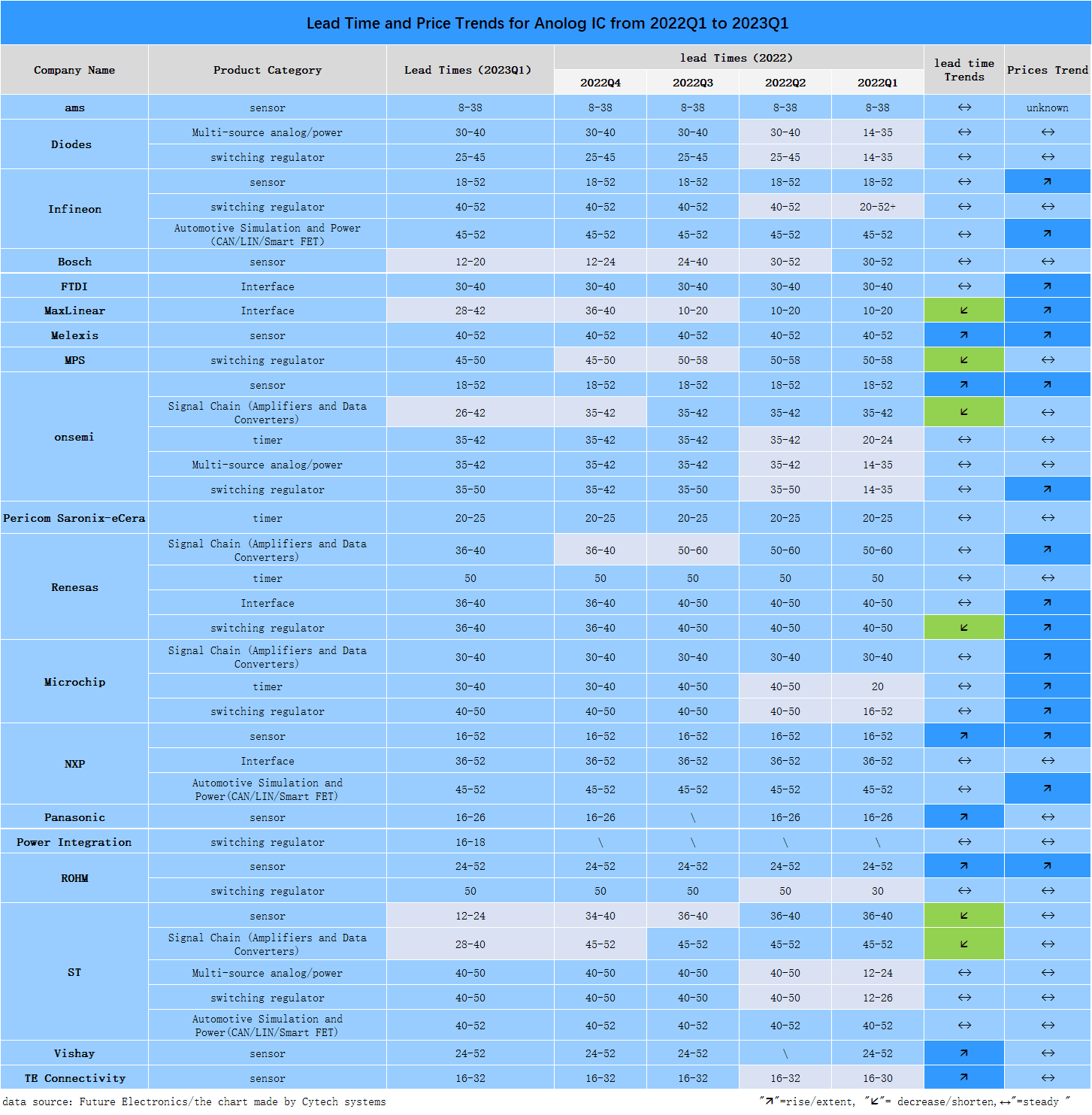

The statistics in the chart below cover the supply status of 19 analog core suppliers and 38 product lines, including information on delivery dates, delivery trends, and price trends. The data comes from Future Electronics, a global electronic components agency company.

According to the data, compared with the previous quarter (2022Q1), in the first quarter of this year (2023Q1), some suppliers’ product lead times have been significantly shortened. STMicroelectronics’ sensors lead time has changed from " 34-40" weeks to "12-24" weeks, its lead time of signal chain products was shortened from "45-52" weeks to "28-40" weeks, and ON Semiconductor's signal chain lead time was shortened from at least 35 weeks to 26 weeks , Bosch's sensor lead time has been shortened from a maximum of 24 weeks to 20 weeks.

What’s more,the data shows that the lead times of various analog suppliers are different. Among them, the lead times of some suppliers are shortening, such as the signal chain products of STMicroelectronics, the switching regulator products of Renesas, the interface products of Maxlinear, and the switching regulator products of MPS.

On the contrary, the lead time of sensors from some suppliers tends to be extended, including core suppliers such as NXP, ON Semiconductor, Rohm, Melexis, Panasonic, Vishay, and TE Connectivity. It is worth noting that although the lead time of sensor products from many suppliers has been lengthened, ST's sensor products have shown a trend of shortening.

For product prices,the data shows that most of the analog suppliers are in a stable state, and the product prices of some analog suppliers are still on the rise, such as Infineon’s automotive analog and power products, NXP’s sensors, Automotive analog and power products, Microchip's signal chain, timers, and switching regulators, ON Semiconductor's sensors, Renesas' signal chain and switching regulators, and other products all have an upward trend in price.

Overall, the supply of analog IC has improved this year, and the market remains hot. The supply situation of suppliers varies. We will continue to observe in the future. Welcome to continue to pay attention to the updates from Cytech Systems.