Motivated by Memory's Strong Momentum! The WSTS Forecasts a 13% Growth in the Semiconductor Market for 2024

Global economic sluggishness, coupled with inflation, is taking a toll on consumer electronic market and multiple industries during 2023. Consequently, the entire industry chain is facing challenging times. Semiconductor firms are facing declining performance, frequent layoffs, and many are taking steps like reducing spending and adjusting capacity to navigate the current downturn.

Looking forward to 2024, uncertainties remain. Will the semiconductor industry recover as expected? What are the key factors influencing market trends?

The WSTS raised expectations from its early forecast

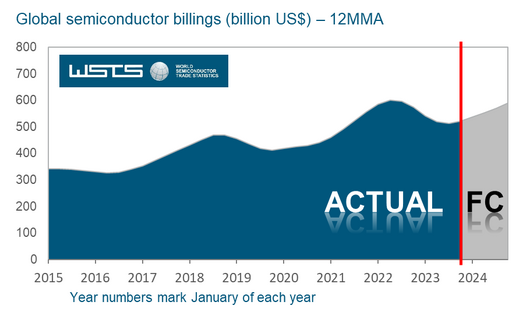

Despite a significant downturn in the semiconductor market throughout 2023, signs of improvement are emerging as the year comes to an end. The global semiconductor market grew on a month-to-month basis for the eighth consecutive time in October, demonstrating positive momentum for chip demand.According to the chart compiled by WSTS below, the global semiconductor market underwent a substantial decline in the second half of 2022 before showing an upward trend towards the end of 2023.

Image Source:WSTS

The WSTS has revised its forecast, anticipating a contraction in the global semiconductor market of 9.4 % in 2023,Slightly higher than the forecast of $515.1 billion in spring.

◆ Discrete Semiconductors are projected to experience a 5.8 % y-o-y growth. However, all Integrated Circuit categories are anticipated to witness an 8.9 % decline compared to the previous year.

◆ Only the European market is projected to experience growth in2023, with an increase of 5.9%. Conversely, the remaining regions are anticipated to face a downturn.

The world's leading semiconductor companies anticipate differentiation

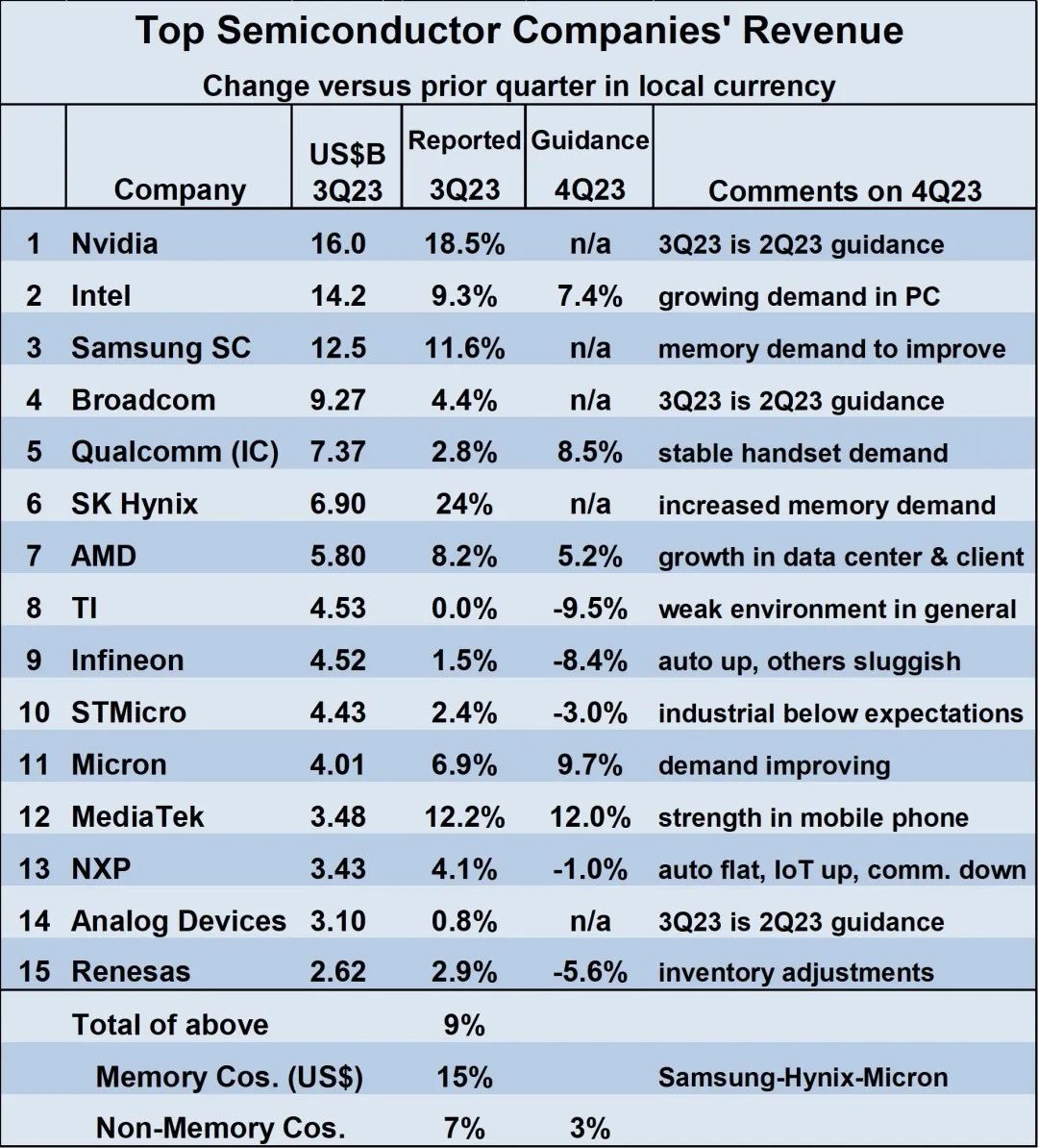

Looking back at the third quarter of this year, the revenues of leading semiconductor companies collectively showed a positive quarter-on-quarter growth. However, there is a divergence in expectations for Q4 performance among these companies.

Among the 10 companies that have released guidance, 5 predict an increase in Q4 revenue compared to Q3, while the other 5 forecast a decline. These 5 companies is expected to be driven by the recovery of the personal computer and smartphone markets. However, the rest of them expecting a decline in revenue are closely tied to the automotive industry, namely Texas Instruments, Infineon, STMicroelectronics, NXP Semiconductors, and Renesas.

Image Source:SC-IQ

The market is expected to recover In 2024, with significant growth in two region

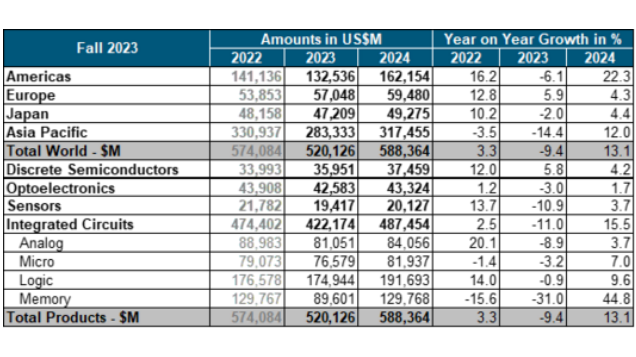

The WSTS expects the semiconductor market to grow by 13.1% next year, reaching $588 billion.

The outlook for 2024, according to the WSTS, points to a vigorous upswing in the worldwide semiconductor market, with projections indicating a 13.1 % increase, reaching a valuation of US$588 billion.

◆ This growth is expected to be largely fuelled by the Memory sector, which is on track to soar to around US$130 billion in 2024, representing an upward trend of 44.8% from the previous year.

◆The majority of other principal segments, including Discrete, Sensors, Analog, Logic, and Micro, are also expected to record single-digit growth rates.

◆ From a regional standpoint, all markets are poised for ongoing expansion in 2024. The Americas and Asia Pacific, in particular, are forecasted to demonstrate significant double-digit growth on a y-o-year basis——22.3% and 12% respectively. The European region is projected to grow by 4.3%, and the Japanese region by 4.4%.

Image Source:WTST

For 2024, the support for semiconductor market growth lies in the anticipated recovery of two key drivers ——the imminent end of the decline in smartphone and personal computer sales, signaling the beginning of a path to recovery.

Thus, it is expected that the companies focusing on memory, PC, computing, or smartphone businesses will experience the strongest revenue growth in 2024. The companies focused primarily on automotive, industrial and IoT will show relatively less revenue growth.

Due to ongoing global economic uncertainty and geopolitical factors, many companies continue to adopt a cautious stance. Nevertheless, there are signs of recovery in the industry at present, and reports from various global market research agencies are bolstering confidence in the growth of the semiconductor market in 2024.

Disclaimer: This article is provided for general information and reference purposes only. The opinions, beliefs, and viewpoints expressed by the author of this article do not necessarily reflect the opinions, beliefs, and viewpoints of Cytech Systems or official policies of Cytech Systems.