The Earthquake's Impact on TSMC and What Can Be Gleaned from Its Financial Report

Amid the global AI boom, TSMC, the world's largest semiconductor foundry, has significantly benefited. The company has recently announced its Q1 revenue increased by 16.5% year-on-year to NT$592.64 billion, and net profit rose by 8.9% year-on-year to NT$225.49 billion. The growth was mainly driven by strong demand for AI applications and high-performance computing (HPC).

TSMC expects seasonal adjustments in the smartphone sector to persist in the second quarter, but the business will continue to be supported by strong demand for advanced 3nm and 5nm technologies. Q2 revenue is forecasted to be $19.6-20.4 billion, with a quarterly growth of approximately 4%-8%.

TSMC : the earthquake will result in a loss of NT$3 billion

On April 3, Taiwan, China experienced its most severe earthquake in 25 years. Yesterday (18th), TSMC publicly disclosed the impact of the earthquake for the first time, with preliminary estimates indicating that the related earthquake losses, after deducting insurance claims, will amount to approximately NT$3 billion (approximately RMB 668 million) to be recognized in the second quarter.1

Business Structure and Revenue Analysis

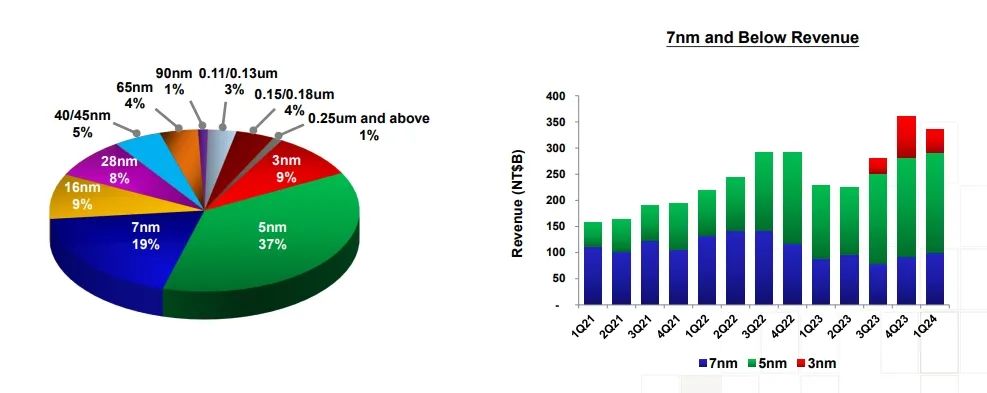

From a technical perspective, 3nm process technology accounted for 9% of the total wafer revenue in the first quarter of 2024, with 5nm and 7nm processes accounting for 37% and 19%, respectively. Thus, advanced technologies at 7nm and below accounted for 65% of the total.

Source: TSMC

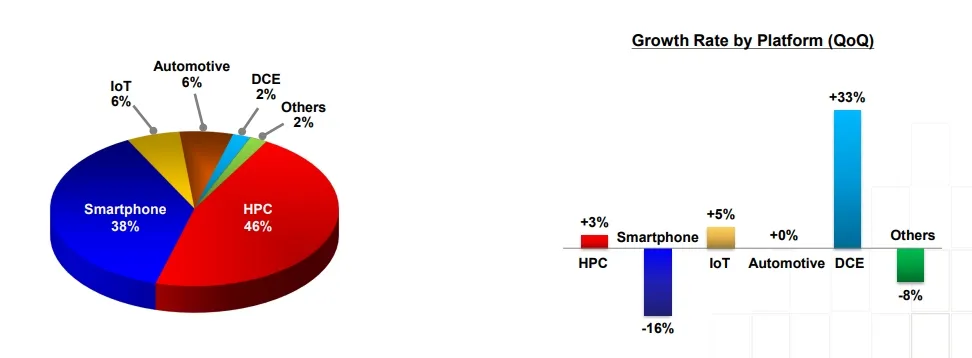

From the application perspective, HPC and smartphones account for 46% and 38% of total revenue, respectively, while IoT, automotive, DCE, and others account for 6%, 6%, 2%, and 2%, respectively. In the first quarter, HPC, IoT, and DCE business revenues increased by 3%, 5%, and 33%, respectively, while smartphone and other business revenues decreased by 16% and 8%, respectively. Automotive business revenue remained flat compared to the previous quarter.

Source: TSMC

From a geographical perspective, North America accounted for 69% of total revenue in the first quarter of 2024, while revenue from China, the Asia-Pacific region, Japan, and EMEA (Europe, Middle East, and Africa) accounted for 9%, 12%, 6%, and 4%, respectively.

Capital expenditure for 2024 remains unchanged

TSMC's first-quarter capital expenditure totaled $5.77 billion, higher than the $5.24 billion in the previous quarter (2023 Q4).

Regarding the annual capital expenditure, TSMC maintains its previous target of $28 to $32 billion unchanged.2

Under substantial capital expenditure, TSMC's global footprint is expanding. The company's latest overseas deployments reveal a series of significant actions, with plans for factories in the United States, Japan, and Germany all in progress.

Outlook for 2024: revised down the global wafer foundry industry valuation by 10%

While TSMC's growth targets for this year remain unchanged, the company has assessed that the recovery pace of some industries is slower than expected. Consequently, it has revised down the growth forecast for the global wafer foundry industry from the previous 20% to 10%.3

From the perspective of end applications, high-performance computing (HPC) and artificial intelligence (AI) applications remain robust, the smartphone market maintains steady growth, the personal computer market is recovering slowly, the Internet of Things (IoT) and consumer goods industries are still adjusting, while the automotive industry is digesting inventory.